You can start investing with Plum with just £1. Once you’re up and running, you can start adding as much money as you feel comfortable with to your investments from your automated savings or via manual deposits. But how much should you invest and how often?

How much should you invest?

We talked about fees and some things to consider when deciding to invest your money in ‘Is investing right for me?’ Once you have decided you want to start investing the next big question is how much.

While the amount you should invest depends on your own financial situation, there are some key things to keep in mind.

First, your capital is at risk if you invest and so you need to make sure you’re comfortable with the risk and fully understand how investment works with Plum.

Access to funds

Withdrawing your money takes about a week - so you can't use your Plum investments for urgent purchases or emergencies. Make sure you have your emergency fund sorted and keep it separate from your investments so it is easy to access instantly.

Investment goal

It is good to have a goal in mind for your investments. This will help you decide how long you are expecting to hold the funds for and how much you need to put into your investments.

Investing makes the most sense for long term goals. Investing carries risk which means that even if you were to get a good return over 5-10 years, your money could lose value next month. Investments WILL go up and down no matter which fund you pick. This also means that you do not have to invest everything right away, in fact, we believe that little and often is a far better approach as we discuss below.

Outweigh fees

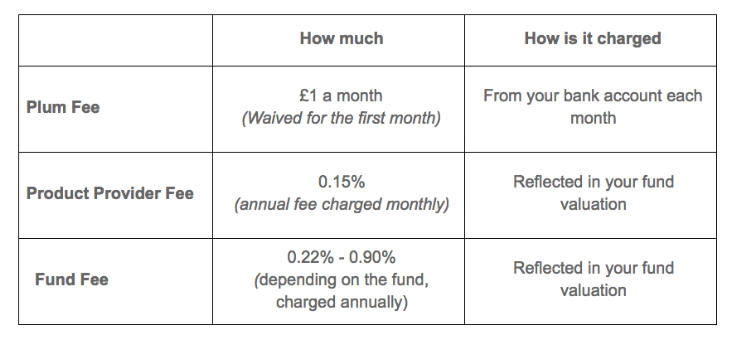

While the rest of Plum is free to use, there are fees for investing with Plum. There is a £1 monthly charge which goes to Plum, a 0.15% annual fee (charged monthly) for our product provider and fund specific fees (0.22-0.90% depending on the fund, charged annually). You can find the fees specific to each fund by reading the fund overview in Plum.

To calculate how much to invest to outweigh the Plum fee of £12 per year, you can calculate it as a percentage of the amount you have invested. You can then compare this to the returns you expect from investing

You can do this using the below calculation:

100 x (ANNUAL FEE / ANNUAL AMOUNT INVESTED) = % expected return

If you invest £300, you would need to achieve a 4% return to overcome the Plum fee of £12 over a year.

100 x (12/300) = 4%

How often should I top up my investments?

Plum Investments is well suited to passive investing.

Passive investing means leaving your money invested in your selected funds for a few years and/or contributing to the same fund regularly for a long time. Overall, markets tend to go up over time, so by leaving your money where it should grow with the markets. If the markets go down, you can leave your money in the fund and wait for the market to recover and continue to grow. You can also maximise the compound effect - where you reinvest returns from an investment, rather than cashing them out, so that any return in the next period is earned on the original invested sum plus any returns made. However, any losses would then be made on the compound amount rather than the original sum. Compound investing over the long term should yield higher results.

Soon, you will be able to automatically invest a percentage of your choice of what Plum saves for you into funds you have selected. In the meantime, decide how much of your Plum savings you want to put into investments each month, e.g. 50% of what Plum saves for you.

Sticking to a regular percentage can help to build up your investments consistently and avoid getting tempted to put more in when funds are doing well and less when funds are down. This is important because when funds are down and you invest, you acquire far more stocks for the same amount invested. This means if funds come back up again, your returns are far greater than if you had invested when the funds were already up (and visa versa). Investing consistently in this way can help manage fluctuations in the market and keep a long term view. If any doubt, we advise you to consult a financial adviser.

If you'd like to learn more about Plum then you can check out our website.

Download PlumFor all the latest Plum news and discussion, keep an eye on our Facebook group, Plum Squad, or follow us on Instagram and Twitter.