What does it mean to invest with Plum?

Plum Investments allow you to invest in "Mutual Funds", which means you to invest in lots of different companies via one "fund". Usually, these require large investments and have additional charges like transaction costs, but with Plum you can trade without any transaction costs and make investments as small as £1 💜

Plum has 2 fund types, Basic and Advanced, and 6 different individual funds:

Basic Funds - are based around risk levels, funds in this category are Conservative, Balanced and Growth. Explained in details here.

Advanced funds - are based around certain "themes", funds in this category are Ethical, Tech and Emerging Markets. Explained in details here.

When you invest in a fund, you own part of the companies in that fund. If the companies these funds are invested in do well, then your funds make money because your share in these companies increases in value. Plus, when these companies pay out profits to shareholders, this is added to the value of your fund 📈

If these companies don't do well, then these funds might lose value or pay out less profits 📉 This is why investing involves risk. If you choose to sell your investments in a fund when it is less valuable than when you bought it, you lose money. To give you an idea of how risky a fund is, you can see the industry recognised risk score (1-7) on the fund pages. The higher the score, the higher the risk.

Are there fees?

Plum Investing isn’t free, so it is important you consider how much you are investing to make sure it is worth it for you.

So that we can keep our lights on Plum charges £1 a month to allow you to invest. Good news this will only be charged monthly from October 2018 - we are giving you a few months free to give investing a go - so if you invest now you will get a few months for free 🎉 To give you a bit of extra time to build up your investments, this fee is waived for the first month.

There are also fund fees (0.22%-1.1% of the value of the fund) which go to the fund providers rather than Plum itself. You can find fund fees in the fund pages, these are deducted automatically from your holdings.

How do I open an investment account?

With Plum you can start investing in a few minutes in 6 different funds within the same investment account.

1) To get started, type 'investments' or 'start investing' into Plum.

2) You'll be asked a few simple questions, and then guided through the account opening and the basics you need to know before getting started.

3) Open an ISA or General Investment Account (you'll need your National Insurance Number, so have it ready).If you don’t already have an ISA, it could save you in taxes to open an ISA. Although remember, tax treatment is dependent on your individual circumstances and may be subject to change in the future.

4) Pick you first fund. After you've confirmed what fund you want to start with you, we'll perform the checks needed to open your account. We might need to ask you for an ID Document, but in most cases we'll be able to open your account without asking further information.

Then your account is opened and you can now make your first investment!

What happens next?

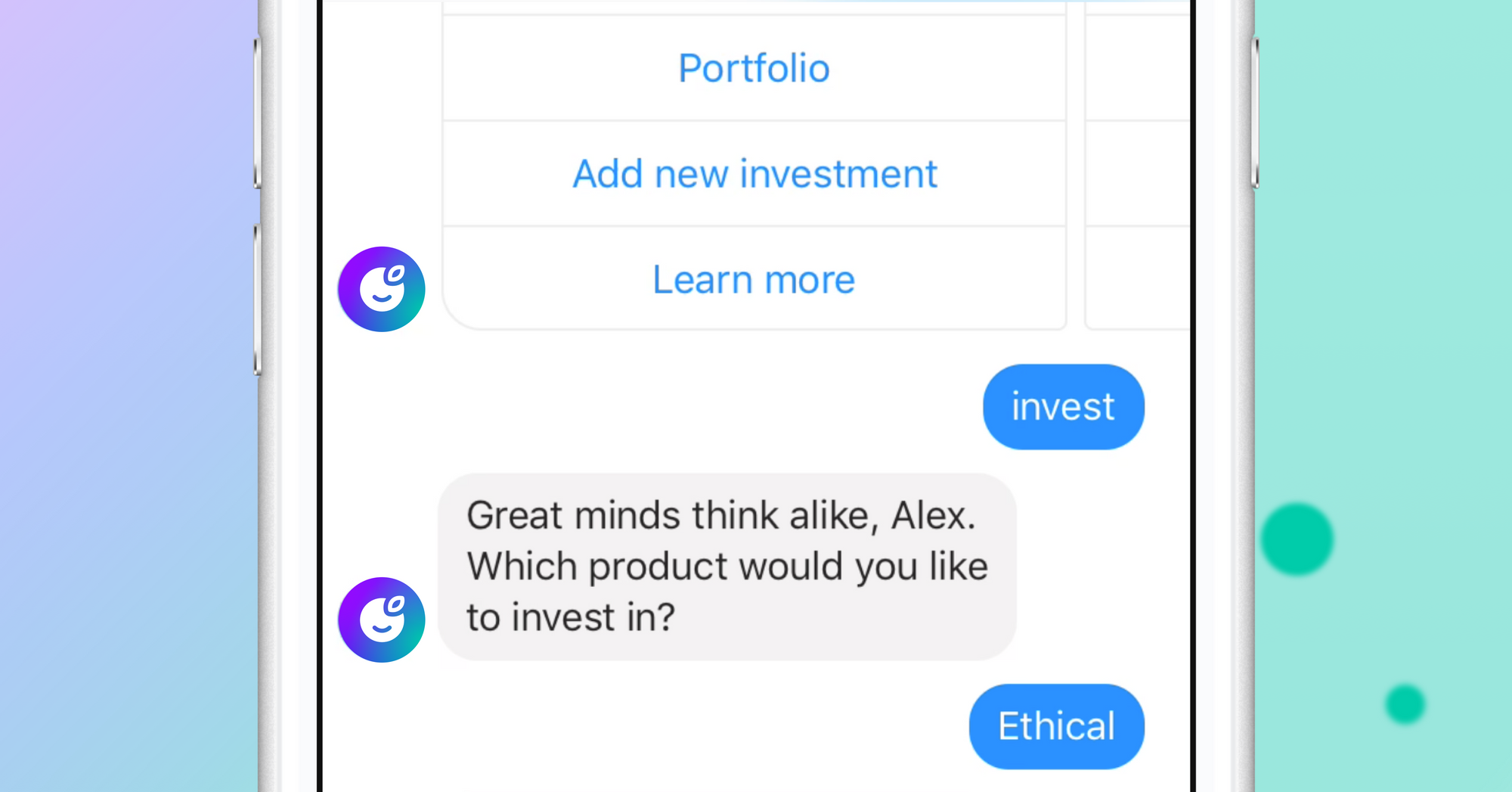

Deposit into you fund. You now have an investment account but you still need to deposit some money into your fund. To do that just type ‘invest’ and the amount you would like to invest into your fund. If you have opened more than one, you will be able to choose which one to invest in.

Add more funds. You can add more funds to your portfolio by clicking the 'add new investment' button. We intend to add extra funds based on popular demand. Vote for them over on in the Plum Squad. You can read more about how investments works, and the details of deposits and withdrawals here

Invest regularly. Investing has the most benefit in the long run if you contribute regularly to build up your capital invested. Soon we'll launch an automatic investment feature which will enable you to invest regularly without having to think about it! In the meantime you can add more to your existing investments by typing ‘invest’ as above.

Check your returns. You can check the returns of your portfolio, and individual funds in the overview pages.

Download Plum