Plum is a finance savvy chatbot that uses AI to help you manage your money and be better off. IIn ‘Savings Squad’, we feature all the best tips and tricks to help you make the most of your money. You can also join our Facebook group of people saving with Plum for more tips and advice from real users.

In the last few years, personal finance and banking has dramatically changed thanks to smart new technology.

Let's take a closer look at 5 of the most innovative UK FinTech companies which will save you money based on your needs.

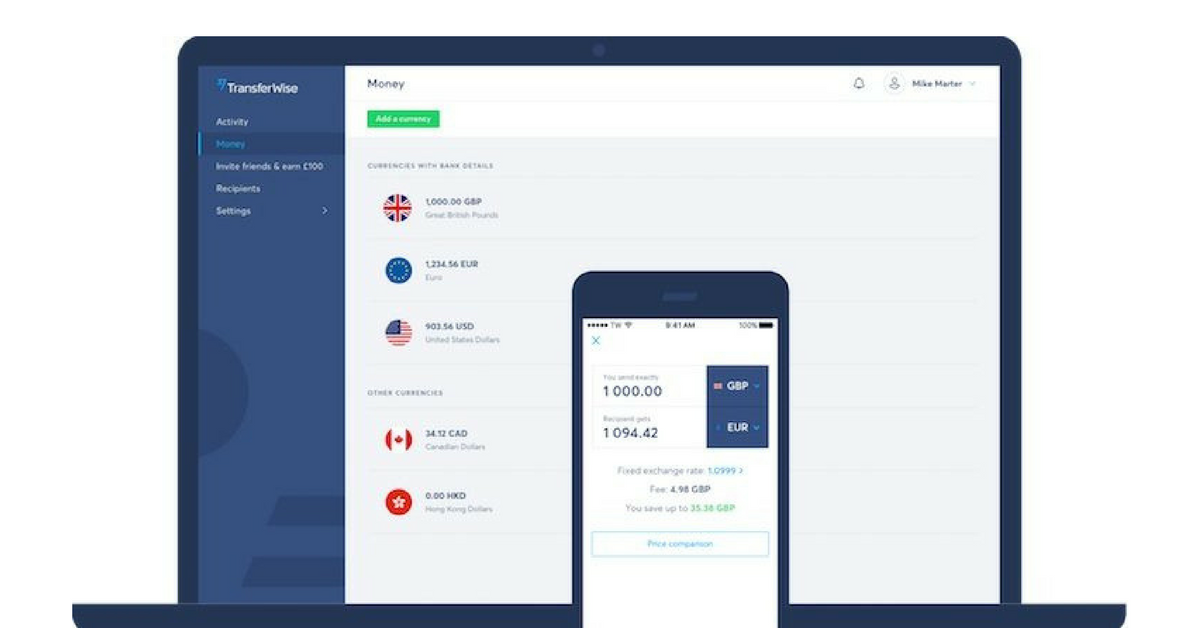

1. TransferWise

Need to send money abroad?

TransferWise is a UK-based peer-to-peer money transfer service launched in 2011.

If you need to send money in another currency, TransferWise is arguably the fastest and cheapest solution on market. Their motto is about transparency directly opposing banks and other providers commonly vague on costs and adding a markup to their exchange rate.

How it works:

- Kathrin in Germany wants to send money to John the UK

- Kathrin's money goes to TransferWise German account

- TransferWise automatically matches her euro-to-pound transactions with other users sending money in opposite direction

- John receives the money in pounds through a local transfer from TransferWise

- Money has actually not moved abroad cutting exchanges fees

They now claim to move over £500 million every month globally and saving people £22 million in hidden charges.

You can check them out here.

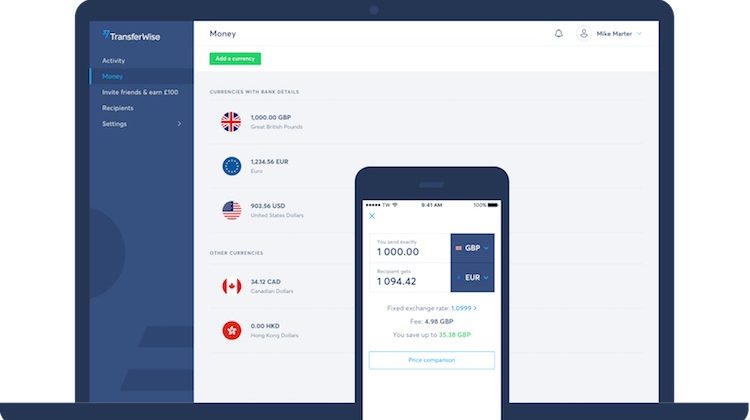

2. Plum

Need to build your savings?

An even further step into the future of finance, Plum is an AI-powered Facebook Messenger bot which saves you money automatically.

How it works:

- Connect your bank account to Plum (thanks to Open Banking)

- Plum analyses your transactions every day and learn about your income, expenses and spending patterns.

- Plum uses this knowledge to calculate how much to save

- Plum then transfer small amounts of money every few days

- Earn interest on your Plum savings using the investment feature

Free to use, and the process of saving money become painless, fun and more efficient.

As being within Facebook Messenger, you can chat to Plum and get updated on your savings, investment or other insights.

You can check them out (hum hum, actually us) here.

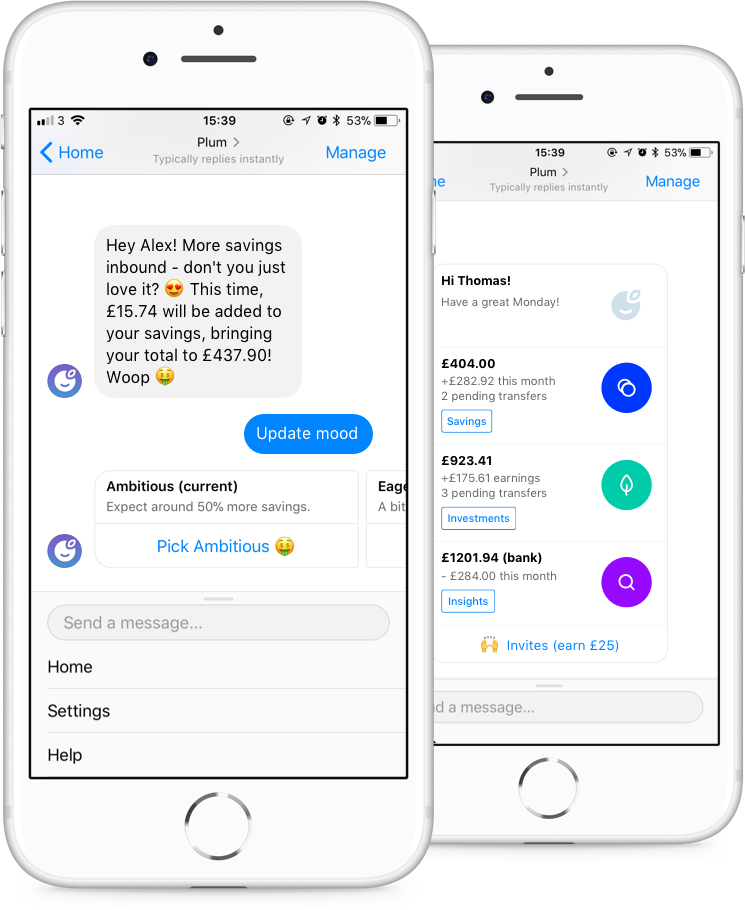

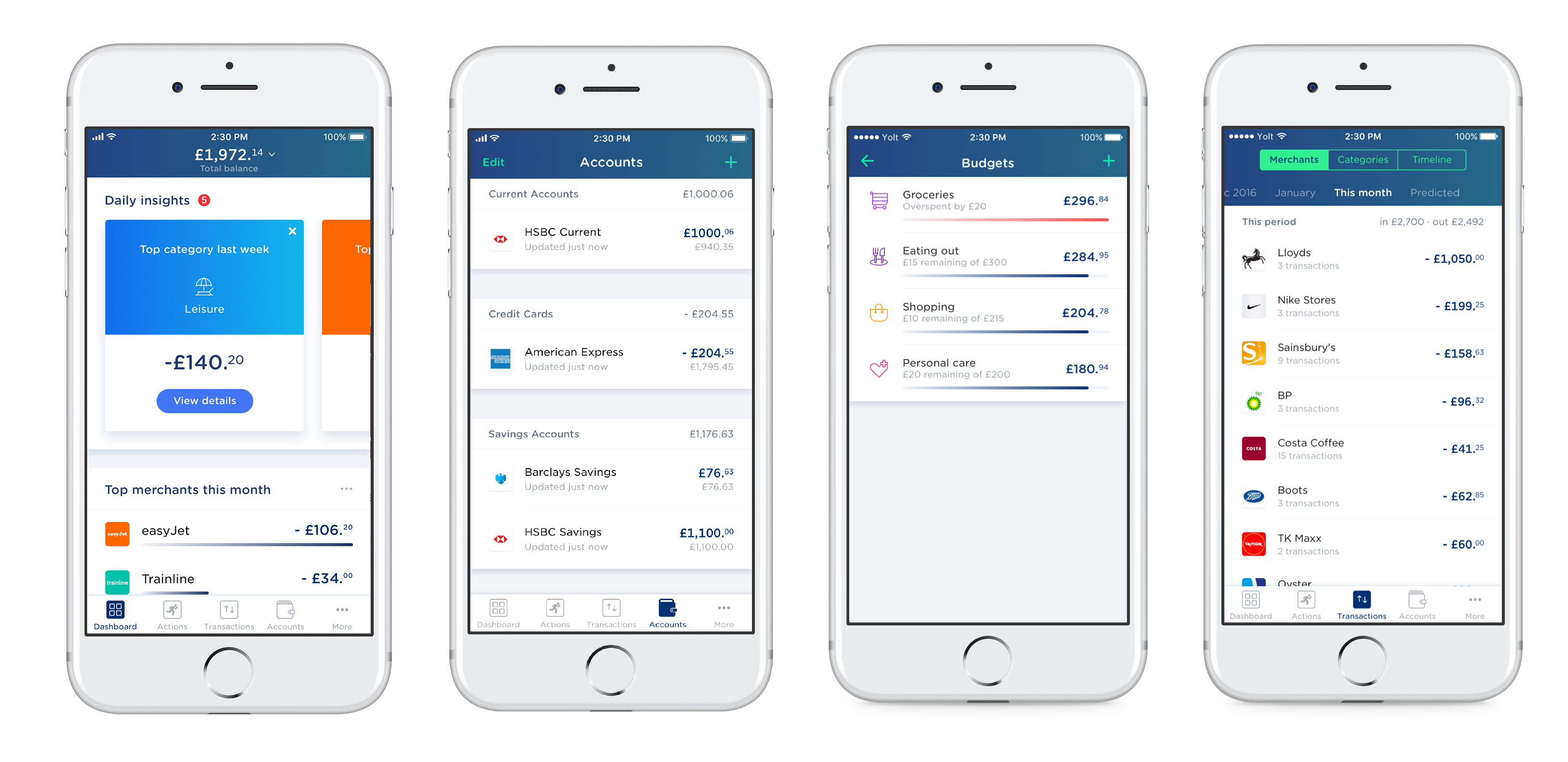

3. Yolt

Need super insights on your money?

Yolt puts all your accounts into one view so you can have a better overview on where you spend more easily.

How it works:

- Your spendings are automatically, and beautifully, allocated into categories

- Daily smart insights so you understand where your money goes

- Monitors your bills and subscriptions

- Set and track budgets for yourself

Possible thanks to Open Banking again!

You can check them out here.

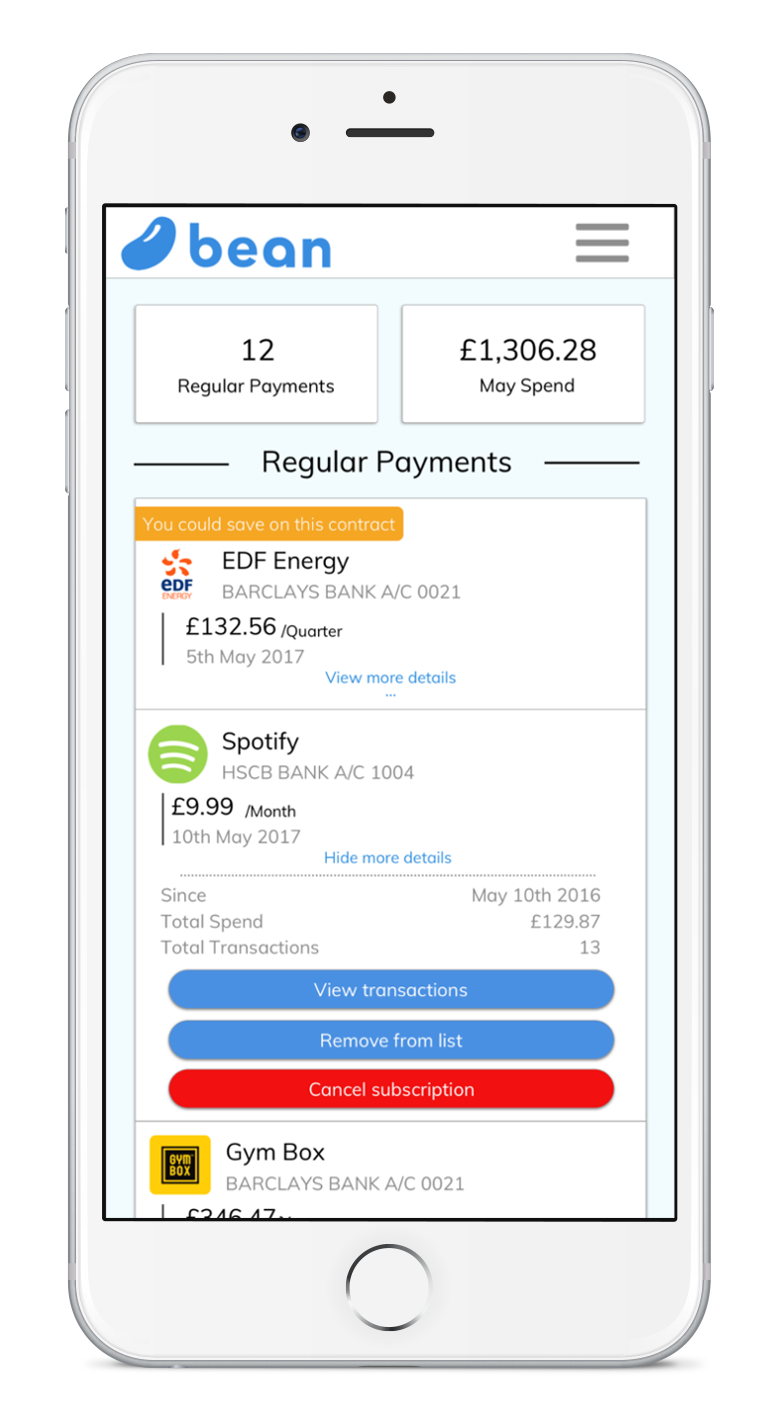

4. Bean

Want to save money on things you don't need?

Bean helps you save money on bills and subscrpitions by scanning your bank accounts and finding all the recurrent costs.

How it works:

- Analyse your bank statement in the background

- Point out the overpriced bills and unused memberships

- Update you when they've found any saving opportunities

- Provide quick switches or help on cancellations.

They claim to save an average of £672 per user - which is not a bad number!

Go Open Banking (n°3)!

You can check them out here.

5. Monzo

Want more modern banking?

Monzo is an app-only bank and recently managed to create a big hype around their product - as it actually does sound cool.

Monzo stands out thanks to its innovative features which make the banking experience a lot easier, smoother and transparent.

How it works:

- Monthly spending targets with notifications when you're spending too quickly

- Easier bank transfer to anyone

- Instant notification when you use your card

- Cool mapping on where you spent money

- Freeze/Defrost your card in one tap

- No fee when spending money abroad (use MasterCard exchange rate - not the real one, but still, this is where it saves you money versus traditional banks)

You can check them out here.

Plum makes managing your money effortless. Get started in just 5 minutes.